california property tax payment plan

On the last business day of the fifth fiscal year after the property originally became tax-defaulted. Processing the application takes 90 days and costs 34 for individuals and 50 for businesses.

Property Taxes Department Of Tax And Collections County Of Santa Clara

Monday through Friday excluding holidays at 925-608-9500.

. 800 am - 500 pm. Bank account Credit card Payment plan. Property buyers and sellers lawyers realtors and relatives of property owners are among those that request property records.

These individuals as well as residents can obtain property records by visiting their local county recorders county clerks or tax assessors offices. Masks are optional for visitors of County facilities but are strongly encouraged. All Current taxes including any supplemental or escaped assessments that may be due must be paid in full prior to April 10.

If you have any questions regarding this payment plan please call the tax collectors office between 900 am. Property Tax Payments can now be made via PayPal with an online service fee of 235 Beginning March 15 2022. Mail homeowners exemption claim to persons newly listed on homeowners property tax exemption cooperative housing information request.

A production fee of 34 will be added to your tax credit when. You may be required to pay electronically. Report to the Board claims for 695 property tax relief approved from January through March.

A convenience fee of 25 will be charged for a credit card transaction. To perform the oversight functions Property Taxes conducts periodic compliance audits surveys of the 58 county assessors programs and develops property tax assessment policies and informational materials to guide county. Complete the 5-Pay Plan application.

Make an initial payment of 20 or more of the delinquent amount due total taxes which includes penalties fees and interest plus a set up fee of 2500. Some information relating to property taxes is. Property owners unable to submit their request online must contact our office at 213-974-2111 to complete.

In California property records are requested for various purposes. If you have any questions regarding this payment plan please call the Tax Collectors Office between 900 am. 4080 Lemon Street 11th floor.

This initial payment must in the form of a certified check money order or cash. Property owners affected by the COVID-19 public health crisis must complete and submit a penalty cancellation request online and include a brief statement of how the public health emergency has impacted their ability to make a timely property tax payment. The California Mortgage Relief Program uses federal Homeowner Assistance Funds to help homeowners get caught up on past-due housing payments and property taxes.

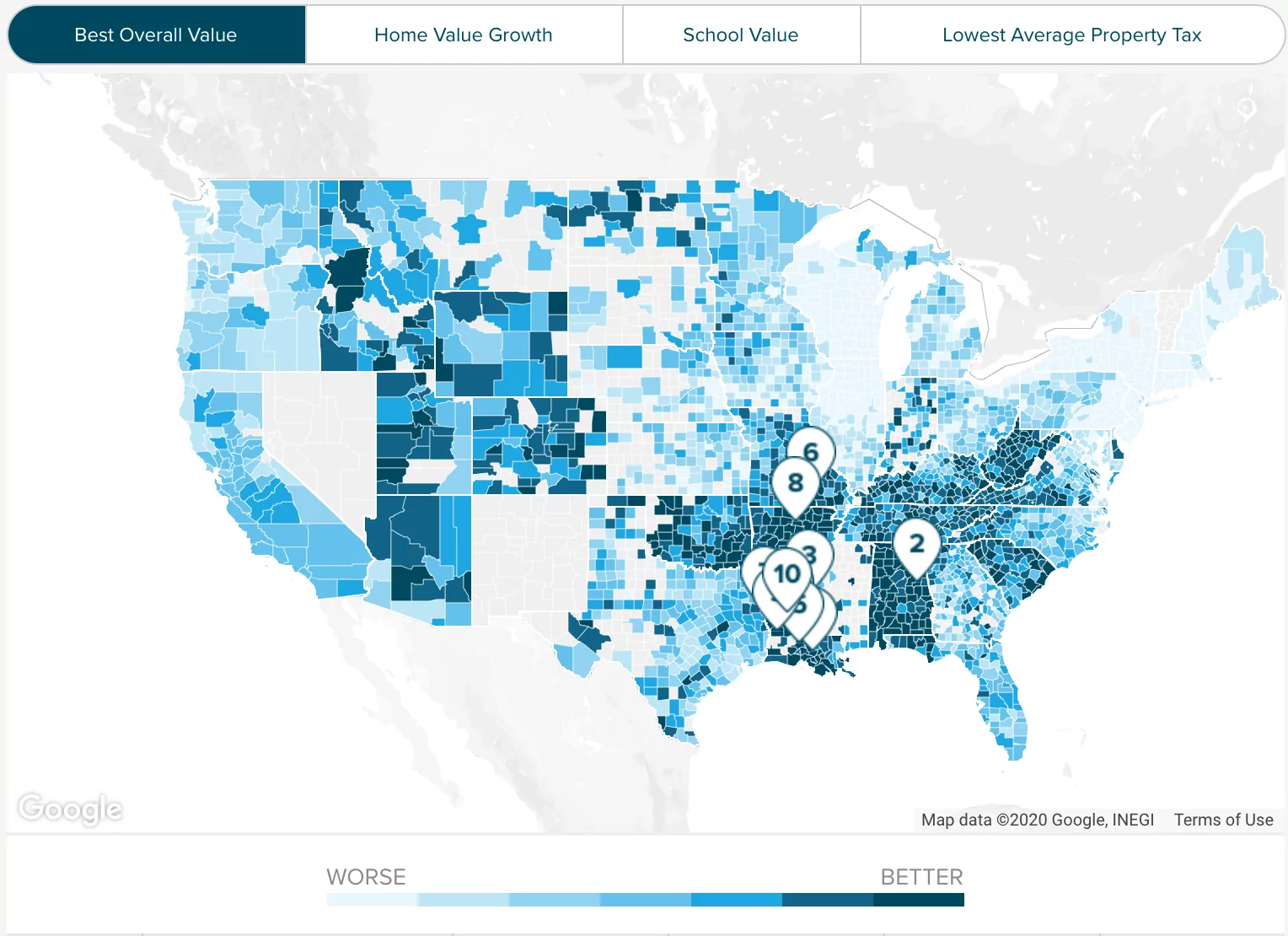

First Monday of each month. While the installment plan is in good. California has one of the highest average property tax rates in the country with only nine states levying higher property taxes.

The program is absolutely free and the funds do not need to be repaid. Individual taxpayers and businesses can apply for instalment plan agreements from the FTB. The deadline to set up a five-year payment plan is 5 pm.

If you elect to make installment payments you must pay 20 percent of the amount due no later than the deadline for filing the written request and have all current and existing delinquent taxes. Tax amount varies by county. Code Regs Title 18 135f By April 1.

Qualifications for a Four-Year Payment Plan. Pay by e-check or credit card using the Treasurer-Tax Collector Departments online payment system and receive an. This plan provides a means of paying secured property taxes that have been delinquent for one or more years with payments being made in a minimum of five installments in accordance with California Revenue and Taxation Code.

If you elect to make installment payments you must pay 20 percent of the amount due no later than the deadline for filing the written request and have all current and existing delinquent taxes. The BOE acts in an oversight capacity to ensure compliance by county assessors with property tax laws regulations and assessment issues. Most prior year delinquent taxes may be eligible for a five year payment plan.

This office is also responsible for the sale of property subject to the power to sell properties that have unpaid property taxes that have been delinquent over five years. The Tax Collectors Office is open to the public from 900 AM - 500 PM Monday through Friday. It also limits increases on assessed values to two percent per year on properties with no change of ownership or no new construction.

Monday through Friday excluding holidays at 925-608-9500. The Office of the Tax Collector is responsible for collecting taxes on all secured and unsecured property in Orange County. The median property tax in California is 074 of a propertys assesed fair market value as property tax per year.

For example if you defaulted on your taxes on June 30 2017 you would have until 5 pm. In addition the first payment of the payment plan which includes 20 of the amount presently required to redeem the property and a 2392 startup fee is required. On June 30 2022 to set up a payment plan 2017 5 2022.

The State Controllers Property Tax Postponement Program allows homeowners who are seniors are blind or have a disability to defer current-year property taxes on their principal residence if they meet certain criteria including at least 40 percent equity in the home and an annual household income of 49017 or less among other requirements. Californias median income is 78973 per year so the median yearly property tax paid by California.

Pay Your Property Taxes Treasurer And Tax Collector

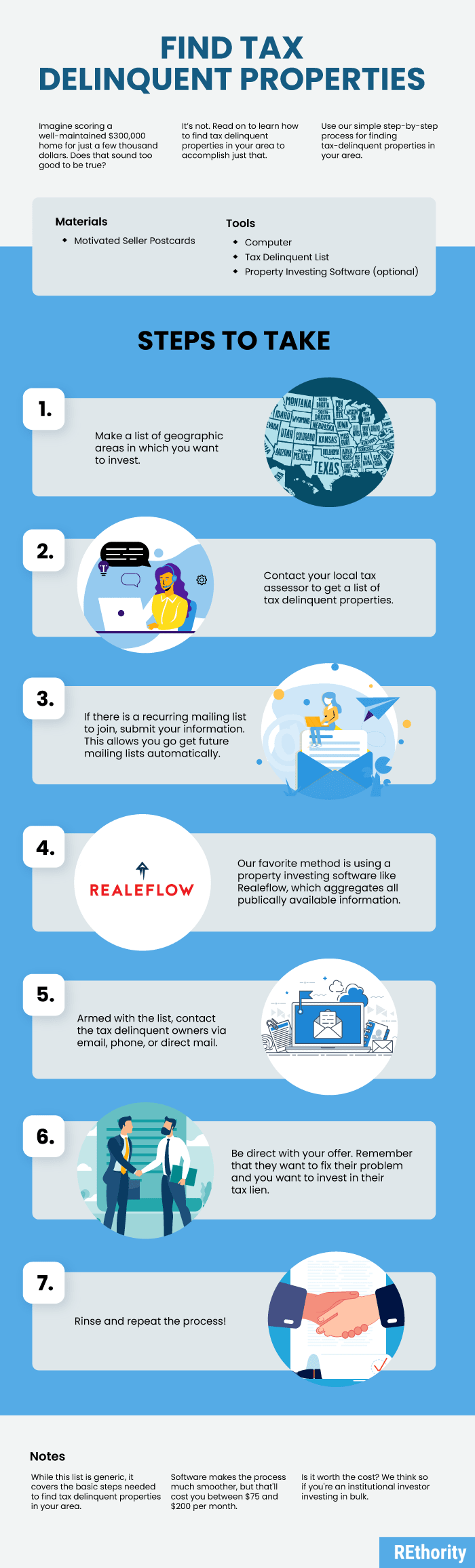

How To Find Tax Delinquent Properties In Your Area Rethority

Secured Property Taxes Treasurer Tax Collector

Santa Clara County Ca Property Tax Calculator Smartasset

Pay Your Property Taxes Treasurer And Tax Collector

Pay Your Property Taxes Treasurer And Tax Collector

Property Tax California H R Block

Property Taxes Department Of Tax And Collections County Of Santa Clara

Pay Your Property Taxes Treasurer And Tax Collector

Pay Your Property Taxes Treasurer And Tax Collector

Pay Your Property Taxes Treasurer And Tax Collector

California Mortgage Relief Program Camortgagehelp Twitter

Property Taxes Department Of Tax And Collections County Of Santa Clara